B2B Toothpaste Manufacturing: Opportunities and Future

Introduction

The global oral care industry, with toothpaste as its flagship product, is undergoing significant transformation driven by evolving consumer preferences, technological innovation, and dynamic B2B collaboration models. According to Statista, the global toothpaste market was valued at over USD 20 billion in 2023 and is projected to grow at a CAGR of 4.8% through 2030. In China alone, the oral care segment saw sales exceeding RMB 50 billion, highlighting the immense potential and competition within this sector.

This article aims to provide a comprehensive analysis of the toothpaste manufacturing industry, focusing on its current landscape, technological advancements, and strategic B2B opportunities. It is crafted for distributors, procurement managers, and industry decision-makers seeking actionable insights and collaboration avenues to thrive in an increasingly competitive market.

Part I: Market Landscape and Competitive Environment

Global and Domestic Market Overview

The toothpaste market continues to experience steady growth, bolstered by rising awareness of dental hygiene and increasing demand for functional and premium products. Major markets include North America, Europe, and the Asia-Pacific region, with China and India being significant growth engines.

Market Size and Growth Trends

Global market value (2023): USD 20.5 billion

Expected CAGR (2023-2030): 4.8%

Asia-Pacific share: Over 40% of global revenue

Industry Standards and Challenges

Manufacturers must comply with strict regulations regarding formulation, safety, and efficacy. Key standards include:

ISO 11609:2022 (Dentifrices – Requirements, test methods, and marking)

FDA and CFDA compliance for fluoride and other active ingredients

Challenges include:

Rising raw material costs (e.g., sorbitol, silica)

Supply chain disruptions post-COVID

High market saturation in urban areas

Market Segmentation and Key Players

Toothpaste products are increasingly diversified into:

Whitening Toothpaste

Herbal/Natural Toothpaste

Anti-sensitivity Products

Children’s Toothpaste

Leading Brands:

Global: Colgate-Palmolive, P&G (Crest), Unilever (Signal), GlaxoSmithKline (Sensodyne)

China: Yunnan Baiyao, Saky, Darlie (Hawley & Hazel)

Emerging players and DTC (Direct-to-Consumer) brands are also reshaping the competitive landscape, leveraging digital channels and niche positioning.

Part II: Technological Innovation and Manufacturing Advancements

Modern Toothpaste Formulation Techniques

Formulation is a key area of innovation, especially in enhancing product performance and safety. Current trends include:

Hydroxyapatite-based remineralization

Probiotic-infused formulations

Fluoride alternatives (e.g., nano-calcium carbonate)

Essential oil and botanical extracts

Smart Manufacturing and Quality Control

Automation and digitalization have revolutionized toothpaste production. Smart factories utilize:

IoT-enabled production lines

AI-driven defect detection and quality assurance

Predictive maintenance systems

These technologies enhance productivity, reduce waste, and ensure consistent product quality.

Sustainability and Green Innovation

Environmental concerns are prompting manufacturers to adopt sustainable practices, such as:

Eco-friendly packaging (biodegradable tubes, recyclable materials)

Sustainable sourcing (RSPO-certified palm oil)

Water and energy-efficient processes

Brands embracing ESG (Environmental, Social, and Governance) principles are gaining favor among both consumers and B2B partners.

Part III: B2B Sales Strategies and Channel Expansion

Traditional vs. Emerging Sales Channels

Traditional retail partnerships remain vital, but newer avenues are gaining traction:

E-commerce platforms (Alibaba, JD.com, Amazon B2B)

Cross-border trade platforms

Pharmacy and clinic channels

Each channel requires a tailored product mix, pricing, and promotional strategy.

Digital Marketing and CRM Integration

B2B sellers are leveraging digital tools to enhance sales efficiency:

CRM platforms (Salesforce, Zoho CRM)

Precision targeting via big data and AI analytics

Automated B2B order systems and dashboards

Case in point: A mid-sized Chinese OEM partnered with a CRM vendor to improve reorder rates by 23% through automated follow-ups and customer segmentation.

Co-branding and Private Labeling

Toothpaste manufacturers increasingly offer:

White-label solutions for retail chains

Custom formulas for dental clinics and wellness brands

These collaborative models help differentiate offerings and build long-term partnerships.

Part IV: Case Studies and Industry Benchmarks

Case Study 1: Yunnan Baiyao’s Functional Leadership

Background: A heritage TCM brand, Yunnan Baiyao successfully entered the oral care sector with medicated toothpaste.

Strategy:

Leveraged patented TCM ingredients

Partnered with dental clinics for trials

Adopted omnichannel distribution (offline + e-commerce)

Results:

Became one of China’s top 3 toothpaste brands within 5 years

Over RMB 3 billion in annual toothpaste sales

Case Study 2: Hello Products (USA) – Sustainability Pioneer

Background: A DTC brand focusing on natural, vegan oral care products

Strategy:

Used fully recyclable packaging

Targeted environmentally conscious millennials via Instagram & YouTube

Collaborated with Whole Foods and Target for retail expansion

Results:

Acquired by Colgate in 2020

Grew from $0 to $40M in revenue within 6 years

Case Study 3: Darlie (China & SEA Market)

Background: Long-standing brand with regional dominance

Strategy:

Tailored flavors and marketing to Southeast Asian tastes

Launched premium whitening sub-brands for middle-class consumers

Adopted cross-border e-commerce expansion

Results:

Maintains >20% market share in Taiwan, Singapore, and Malaysia

Try Lidercare Now!

We Help You Launch New Products, And Continue To Grow. Try Us With 20% Off Your First Order!

Part V: Future Trends and Strategic Recommendations

Future Directions in Product Development

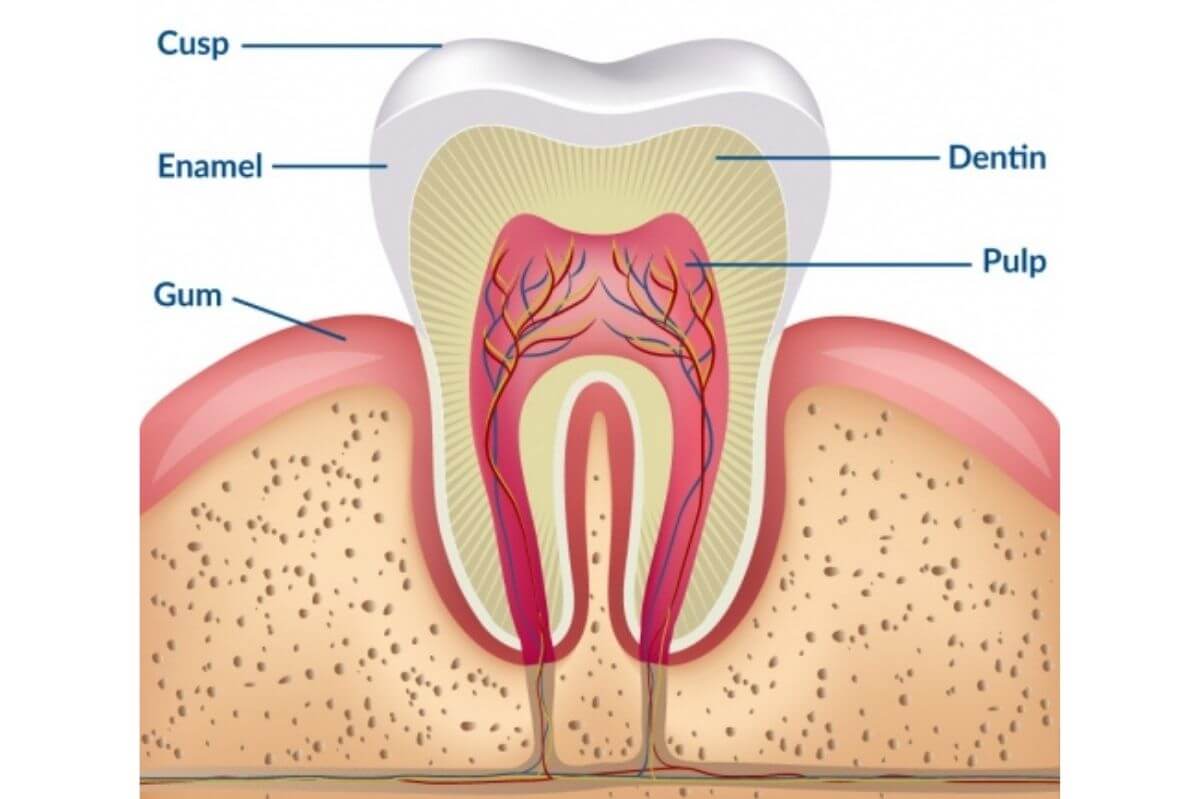

Functional Toothpaste: Targeting specific issues like enamel repair, gum health, or sleep-friendly formulas

Natural & Organic: Demand for chemical-free and cruelty-free products is rising

Smart Oral Care: Integration with apps and smart toothbrushes for tracking oral hygiene

Strategic Advice for B2B Stakeholders

Invest in R&D for unique formulations that cater to niche consumer needs

Digitize operations to streamline procurement and customer service

Pursue ESG compliance to attract premium retailers and export partners

Co-create with clients through white-label services and OEM partnerships

Risk Management

Regulatory Uncertainty: Stay updated with changing FDA/CFDA policies

Supply Chain Volatility: Build multi-source procurement models

Consumer Fatigue: Use data to track trends and refresh SKUs accordingly

Conclusion

The toothpaste manufacturing industry is ripe with opportunity for those ready to innovate, collaborate, and adapt. From advanced production techniques to data-driven B2B marketing, the key to growth lies in embracing transformation while anchoring on quality and trust. Distributors, procurement officers, and brand partners can gain a competitive edge by aligning with manufacturers that prioritize sustainability, digital integration, and market responsiveness.

By strategically navigating this evolving landscape, stakeholders in the oral care industry can forge resilient partnerships and capture growth across global and local markets alike.

References and Data Sources

Table of Contents

Awesome! Share to:

Latest Blog Posts

Check out the latest industry trends and take inspiration from our updated blogs, giving you a fresh insight to help boost your business.